The finance risks and opportunities of decarbonization

Researchers from the institute collaborated with a consortium of 16 leading banks from four continents convened by the UN Environment Program Finance Initiative (UNEP FI) to publish a jointly developed methodology to increase banks’ understanding of how climate change and climate action could impact their business. This understanding is fundamental to enabling banks to be more transparent about their exposure to climate-related risks and opportunities in line with the Task Force on Climate related Financial Disclosures (TCFD). It will also inform banks’ strategies to contribute to and benefit from low-carbon economic transition, and help them engage and support their customers to that effect. This is important because the climate-related risks and opportunities that banks face arise primarily from their services to clients.

The IIASA team contributed to the methodology development and provided detailed scenario data from the MESSAGEix-GLOBIOM integrated assessment model, which formed the basis of the report, together with the Potsdam Institute for Climate Impact Research’s REMIND-MAgPIE model. The team developed risk factor pathways for individual economic sectors in different world regions. Three scenarios were used in the project: a baseline, and deep decarbonization pathways consistent with 2°C and 1.5°C warming. These scenarios were developed within the context of the ongoing European Commission Horizon 2020 research project CD-LINKS, which is coordinated by IIASA.

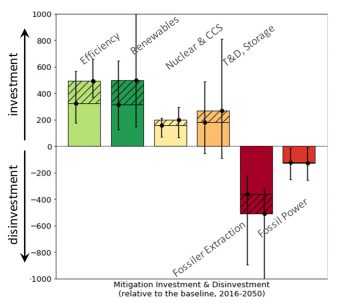

Figure 1: Mitigation Investments and Disinvestments of reaching the climate objective of 2°C and 1.5°C temperature change. Cross-hatched areas indicate additional investment or disinvestment of 1.5°C compared to 2°C. [1]

To keep global temperature rise to 1.5°C or 2°C, investments in low carbon energy and energy efficiency will likely need to overtake investments in fossil fuels as early as 2025 and then grow far higher. The low carbon and energy efficiency “investment gaps” calculated by the researchers are striking. To meet countries’ nationally determined contributions (NDCs), an additional US$130 billion of investment will be needed by 2030, while to achieve the 2°C target the gap is $320 billion, and for 1.5°C, it is $480 billion. These investment figures represent more than a quarter of total energy investments foreseen in the baseline scenario, and up to half in some economies such as China and India.

In addition to the above efforts, IIASA scientists also participated in the Scientific Advisory Group of the Science Based Targets initiative, contributed to the Integrated Assessment Modeling Consortium (IAMC) Working Group on Climate Finance, and participated in several workshops with the financial sector.

References

[1] McCollum D, Zhou W, Bertram C, de Boer H-S, Bosetti V, Busch S, Despres J, Drouet L, et al. (2018). Energy investment needs for fulfilling the Paris Agreement and achieving the Sustainable Development Goals. Nature Energy 3 (7): 589-599.

Further information

Collaborators

- Potsdam Institute for Climate Impact Research (PIK), Germany

- UN Environment (UNEP), Kenya

- World Bank, US

- Euro-Mediterranean Center on Climate Change (CMCC), Italy

- Joint Global Change Research Institute (JCRI), USA

- European Commission Joint Research Centre (JRC), EU

- National Institute for Environmental Studies (NIES), Japan

- PBL Netherlands Environmental Assessment Agency, Netherlands

Related research

- Linking Climate and Development Policies – Leveraging International Networks and Knowledge Sharing (CD-LINKS)

- 16 banks and United Nations produce first guidance to help banking industry become more transparent on climate-related risks and opportunities

- Meeting Paris climate targets will require a substantial reallocation of global investment